About

PensPlan Profi is an open pension fund affiliated with the Pensplan Project, established by PensPlan Invest SGR S.p.A. now Euregio Plus SGR S.p.A.. Thanks to collaboration with Banca Etica Group, the Fund is characterized by investments in financial instruments with a high profile of social and environmental responsibility and by a “life cycle” advisory service that defines the optimal investment scenario based on the age of the member.

The Fund is registered on the Covip Register under number 147.

![]()

![]()

PensPlan Profi Open Pension Fund

![]() Passaggio Duomo, 15 - 39100 Bolzano

Passaggio Duomo, 15 - 39100 Bolzano

![]() 2 Via Romano Guardini, 17 - 38121 Trento

2 Via Romano Guardini, 17 - 38121 Trento

![]() + 39 / 0471 068700 - fax +39 / 0471 068766

+ 39 / 0471 068700 - fax +39 / 0471 068766

![]() profi@euregioplus.com -

profi@euregioplus.com - ![]() www.covip.it

www.covip.it

PEC: fondoprofi@pec.it - ![]() www.euregioplus.com

www.euregioplus.com

Who can join?

All citizens with or without income, including minors.

What are the advantages?

- Increased financial availability for old age through the setting up of a supplementary pension, in addition to the public pension..

- Tax benefits , and therefore the possibility of deducting contributions to the Fund up to a ceiling of Euros 5,164.57 per year and of benefiting from reduced taxation on pension benefits subject to a variable rate from 15% to 9%.

- The employer’s contribution, if provided for by contracts and collective agreements, including company agreements.

- The opportunity of benefiting from a series of advances.

- The possibility of choosing - among different investment sectors - the most suitable one on the basis of one’s particular risk inclination and investment horizon.

- An advisory service on the choice of the sub-fund in relation to age and gender, which over time and as the retirement age approaches, will indicate to the member the opportunity to change the sub-fund through a free alert service.

- The possibility of counting on a double analysis. An environmental, social, and governance analysis integrated with a financial analysis. within the aim of creating value over time.

- The proximity of our contacts and a valid support at a local level.

- The social interventions of the Trentino-South Tyrol Region.

Special "under 18"

- Advantages are foreseen for “under 18” members.

Home savings

Membership of an agreed supplementary pension fund is even more advantageous with the launch of the Home Savings initiative.

A member of a pension fund that has an agreement and meets the requirements can access a loan at preferential conditions, i.e. the MUTUO RISPARMIO CASA [home savings loan], to be requested from the credit institutions participating in the plan.

Responsible investment

![]() Information on the sustainability of the PensPlan Profi Open Pension Fund can be found in the Appendix "Sustainability Disclosure".

Information on the sustainability of the PensPlan Profi Open Pension Fund can be found in the Appendix "Sustainability Disclosure".

Among other things, the PensPlan Profi Pension Fund promotes environmental and/or social characteristics or a combination thereof by also investing in companies that comply with good governance practices pursuant to Article 8 of Regulation (EU) 2019/2088 (SFDR). The product therefore qualifies as a financial product promoting environmental and social characteristics within the meaning of Article 8 of Regulation (EU) 2019/2088 (SFDR).

Compliance with the environmental and social characteristics promoted by the product is conditional on the investment and holding of at least one of the investment options represented by the Sub-Funds, which are themselves classified as per Article 8 SFDR.

In identifying investments that enable the PensPlan Profi Fund to promote environmental and/or social characteristics, Euregio Plus SGR is advised by Etica Sgr S.p.A., an asset management company of the Banca Popolare Etica Group, which provides the Investment Universe of companies, states and agencies that the Fund may invest in.

The selection of issuers is made by Etica Sgr based on social, environmental and governance (ESG) indicators, which are periodically updated.

The analysis of issuers is performed based on data and information provided by companies specialised in analysing the sustainability of issuers using a proprietary method developed by Etica Sgr and represented by the internationally registered trademark ESG EticApproach®.

Issuers are selected following a negative screening (aimed at excluding all issuers deemed to have questionable ESG qualifications) and a positive screening (aimed at selecting issuers exceeding a certain sustainability threshold and/or considered best within their sector according to a best-in-class approach). This analysis is then expanded on by adding specific insights that take into account contingencies related to current events and additional information derived from discussions with the issuers themselves carried out by Etica Sgr and/or based on their level of reputational risk with respect to ESG issues.

Agencies are analysed based on information such as type of business, shareholders and possible ESG disputes.

Etica Sgr also evaluates corporate governance practices through voting at shareholder meetings and a continuous dialogue with issuers. The respect of the social and/or environmental characteristics pursued by the Pension Fund's investments is expressed in the monitoring of the issuers, i.e. in the construction of Etica Sgr’s “Investible Universes”. During the periodic update of these Universes, the analysis process - based on exclusion elements, evaluation elements, ESG scoring and the application of absolute and/or industry thresholds - is fully reviewed. The data linked to each issuer are then updated in light of the improvements or regressions recorded by the companies or states analysed, thus determining the entries and exits from the Universe.

The Fund's investment activities (including through UCIs) are permitted only with respect to the issuers that make up the Universes: any other investment is not allowed.

![]() For more information on how the product promotes environmental and social characteristics, see the Disclosure pursuant to Article 24 of Regulation (EU) 2022/1288.

For more information on how the product promotes environmental and social characteristics, see the Disclosure pursuant to Article 24 of Regulation (EU) 2022/1288.

Microfinance guarantee fund

Membership to the Fund involves the payment of a yearly solidarity contribution of Euro 3 to guarantee microfinance and financial support plans through crowd-funding initiatives managed by Banca Etica.

“Life cycle”

The “life cycle” is a type of investment that involves a gradual reduction in the financial risk of the pension investment, based on the member’s personal data. A life cycle investment plan envisages that, as the retirement age approaches, the degree of risk of the member’s portfolio is modified at predetermined intervals, reducing the invested amount in sub-funds with a higher risk profile to the advantage of those with a lower risk profile. .

The fund, on an optional basis, makes available to members, free of charge, a system of automatic alerts suggesting a reallocation of the pension investment based on the “life cycle” principle.

Agreement with the Trentino-South Tyrol Region

The PensPlan Profi Open Pension Fund is a fund affiliated with Pensplan Centrum S.p.A. Our Region supports the citizens in the constitution of a supplementary pension. A special regional law (no. 3 dated February 27, 1997) has provided for the introduction of special interventions and services in this area.

What are the costs?

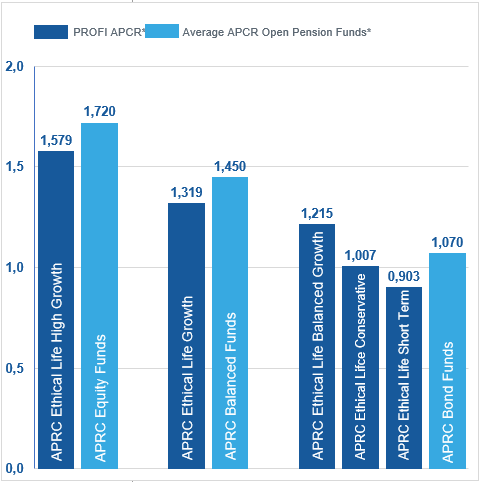

The Synthetic Cost Indicator [APRC] provides a summary indication of the annual costs of the sectors, as a percentage of the accrued individual position. The APRC is calculated by all pension funds using the same methodology established by COVIP.

APRC Pensplan PROFI

Data source: Covip - www.covip.it (year 2023)

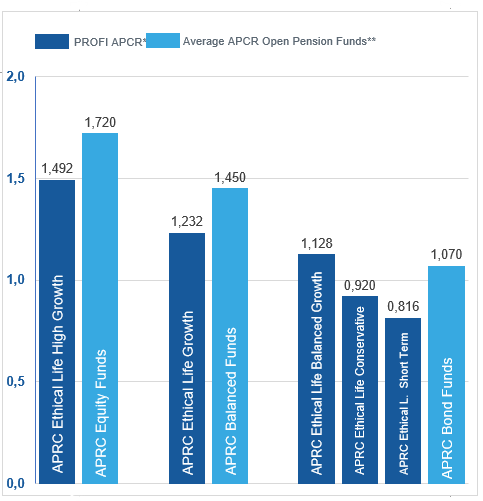

It is important to pay attention to the synthetic cost indicator that characterizes each fund: a 2% instead of 1% APRC can reduce the capital accumulated after 35 years of participation in the pension plan of about 18% (for example, it can reduce it from 100.000 Euros to 82.000 Euros).

* APRC for pension scheme members with more than 10 years of contributions.

Data source: Covip - www.covip.it (year 2023)

It is important to pay attention to the synthetic cost indicator that characterizes each fund: a 2% instead of 1% APRC can reduce the capital accumulated after 35 years of participation in the pension plan of about 18% (for example, it can reduce it from 100.000 Euros to 82.000 Euros).

* APRC for pension scheme members in South Tyrol with more than 10 years of contribution.

** APRC for pension scheme members with more tha 10 year of contribution.

How can you subscribe?

The Fund can be subscribed to at your same company (also possible from remote), by a distributor, or at a partner company.

|

Promotional message regarding complementary types of pension fund – before joining, please read Part I, ‘Key information for members’ and ‘Information Appendix on Sustainability’ of the Information Note. Previous performance is not necessarily a guide to future returns. |